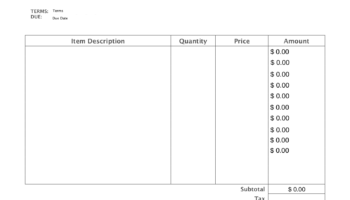

A document utilized to itemize funds being transferred into a bank account is frequently required for deposits made in person or via mail. Often, an individual or business may require a physical record of the deposit for personal or accounting purposes. This necessitates the creation of a paper-based record. A common method to fulfill this need involves generating a document using a computer and printer, ensuring a tangible copy of the deposit details.

The availability of a readily producible record offers several advantages. It allows for efficient record-keeping, facilitates reconciliation with bank statements, and provides supporting documentation for financial audits. The ease of creation and accessibility enhance efficiency in managing financial transactions. Historically, such forms were solely available in pre-printed formats obtained from financial institutions, but the ability to generate these forms independently provides greater flexibility and control.

The subsequent discussion will address the key elements typically included within such a document, explore the software and templates available for its generation, and outline best practices for its accurate completion and secure storage.