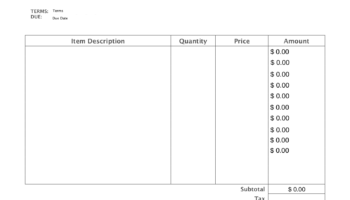

Documents providing a physical record of financial transactions are readily accessible. These resources, often in PDF format, allow individuals to manually track debits, credits, and resulting balances associated with a bank account. A typical example includes columns for date, description of transaction, payment/debit amount, deposit/credit amount, and the running balance.

Maintaining a written log of financial activity offers several advantages. It allows for proactive budget management, assists in reconciling bank statements, and provides a tangible audit trail. Historically, such records were a primary method of personal finance management, predating widespread adoption of digital banking platforms and software.

The following sections will explore the features and utility of these resources, common formats available, and considerations for selecting the appropriate document for individual needs.