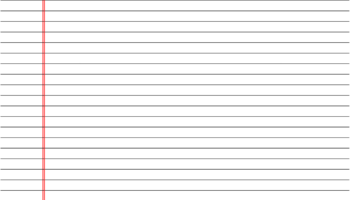

A complimentary document designed for manual recording of financial transactions. This resource facilitates tracking deposits, withdrawals, checks written, and other account activities. It typically includes columns for dates, transaction descriptions, payment amounts, deposit amounts, and the resulting account balance. An example would be a downloadable template that individuals can use to monitor their checking account activity at home.

Maintaining accurate financial records offers numerous advantages, including improved budget management, early identification of errors or fraudulent activity, and simplified reconciliation with bank statements. Historically, these records were essential for personal finance before the widespread adoption of digital banking and automated tracking tools. The availability of no-cost versions democratizes access to essential financial management resources.

The following sections will address considerations when selecting a suitable template, methods for effective utilization, and alternative record-keeping approaches.