Are you looking for a simple and effective way to tackle your debt? Look no further than the debt snowball worksheet! This handy tool can help you organize your debts and create a plan to pay them off one by one.

By listing all your debts from smallest to largest, the debt snowball worksheet allows you to focus on paying off one debt at a time while making minimum payments on the rest. As you eliminate each debt, you gain momentum and motivation to tackle the next one.

debt snowball worksheet

Get Started with a Debt Snowball Worksheet

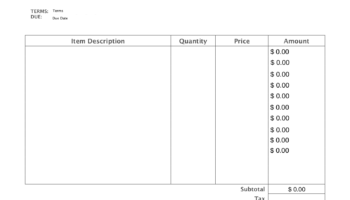

To get started, gather all your debt information including balances, interest rates, and minimum payments. Then, list your debts in order from smallest to largest. Allocate any extra money in your budget towards paying off the smallest debt while making minimum payments on the others.

As you pay off each debt, roll over the amount you were paying towards that debt to the next one on your list. This snowball effect accelerates your debt payoff and helps you stay on track towards financial freedom.

Consistency is key when using a debt snowball worksheet. Stick to your plan, track your progress, and celebrate each milestone along the way. Before you know it, you’ll be debt-free and on your way to a brighter financial future.

Ready to take control of your finances and say goodbye to debt? Download a debt snowball worksheet today and start your journey towards a debt-free life!

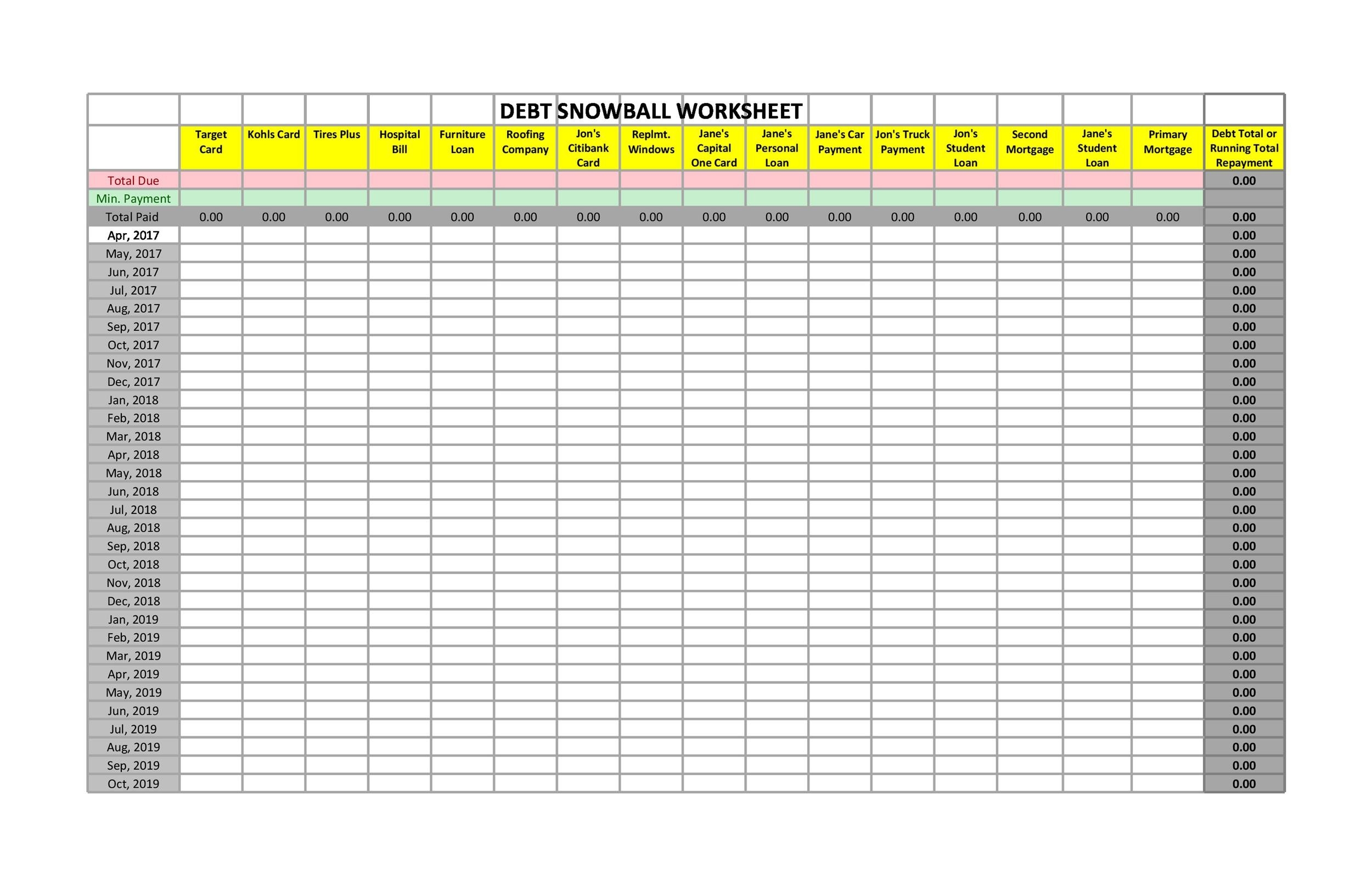

Debt Snowball Tracker Printable A4 Letter digital Download Etsy

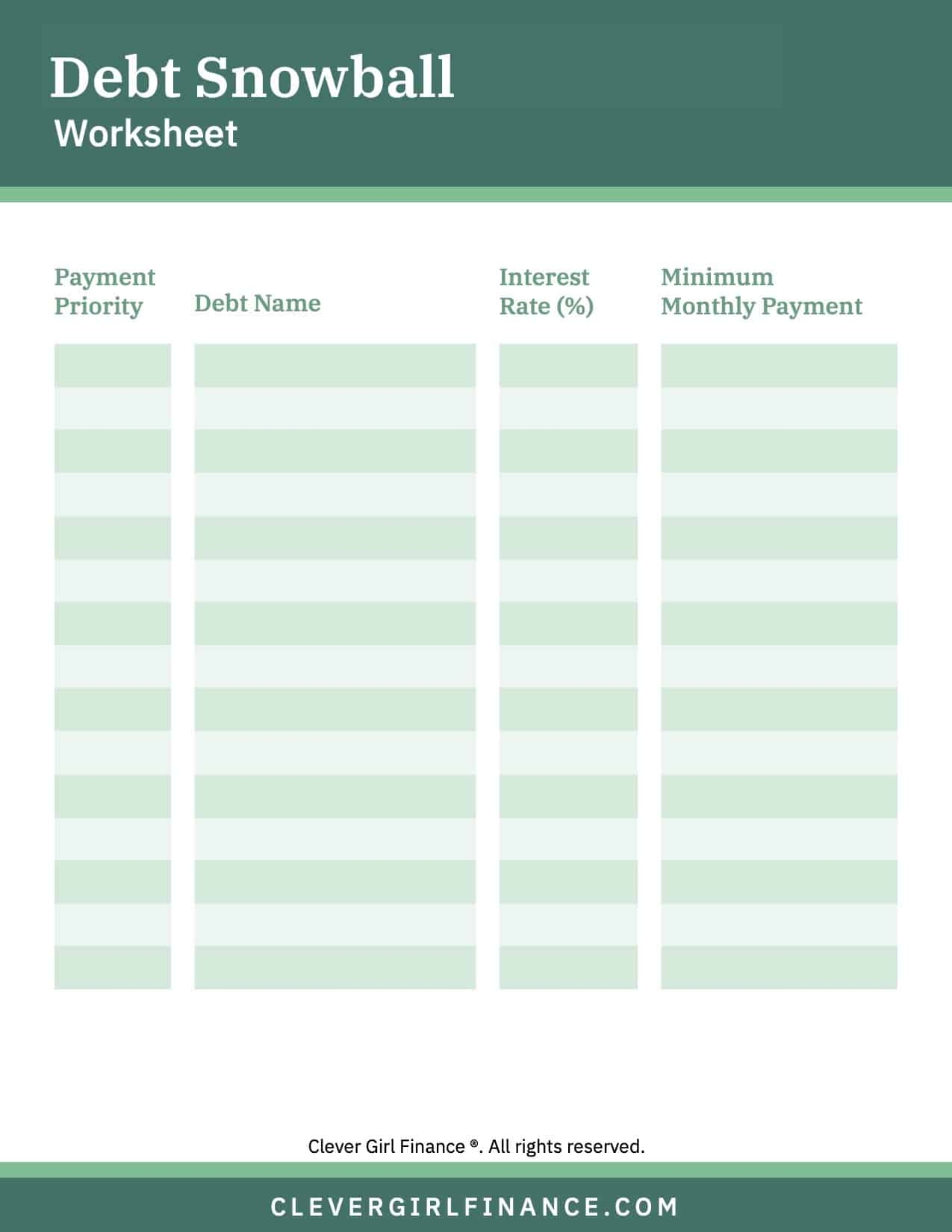

How To Use The Debt Snowball Method Free Debt Snowball Worksheet

Debt Snowball Tracker Printable Debt Payment Worksheet Debt Payoff Progress Log Debt Free Goal Chart Instant Download Etsy

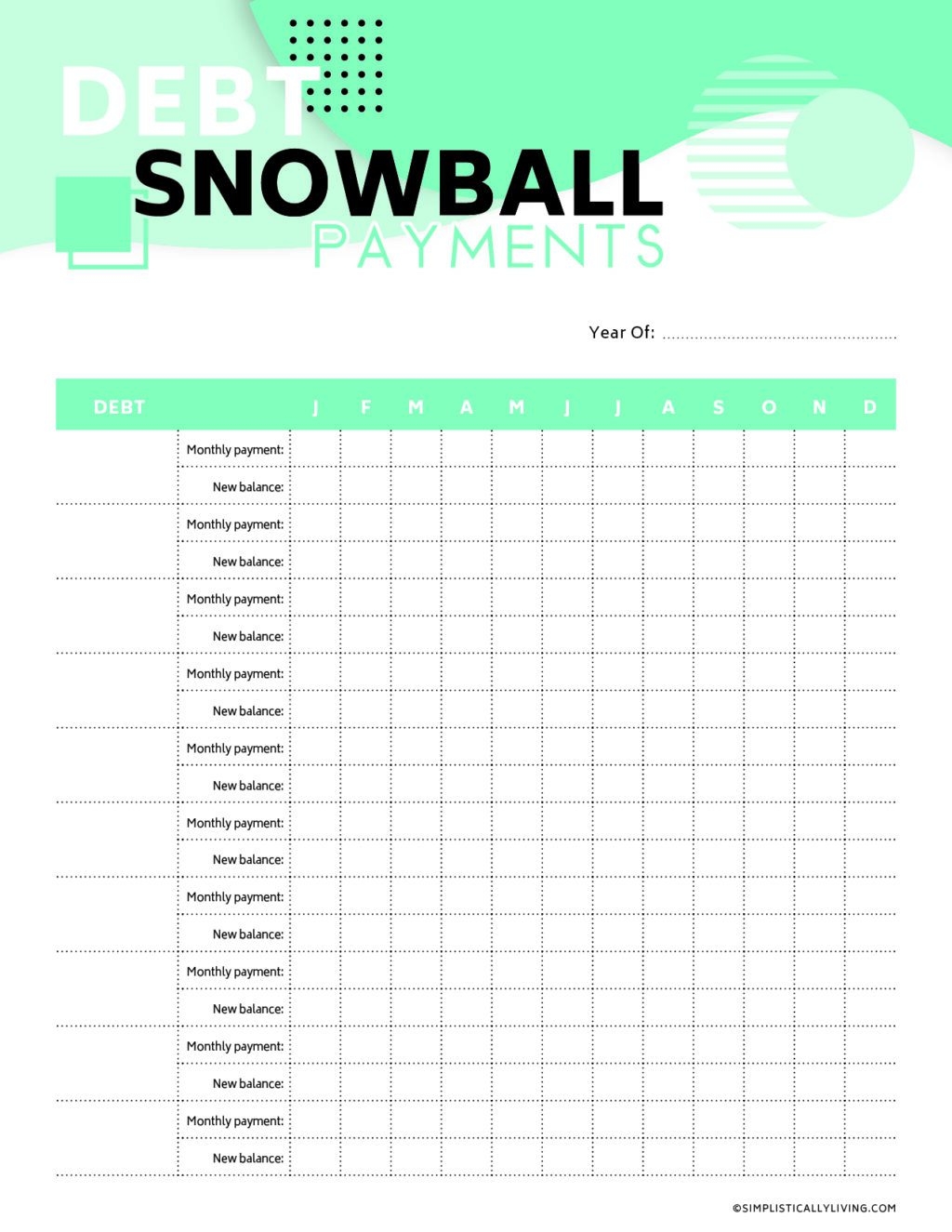

Free Debt Snowball Printable Worksheets Simplistically Living

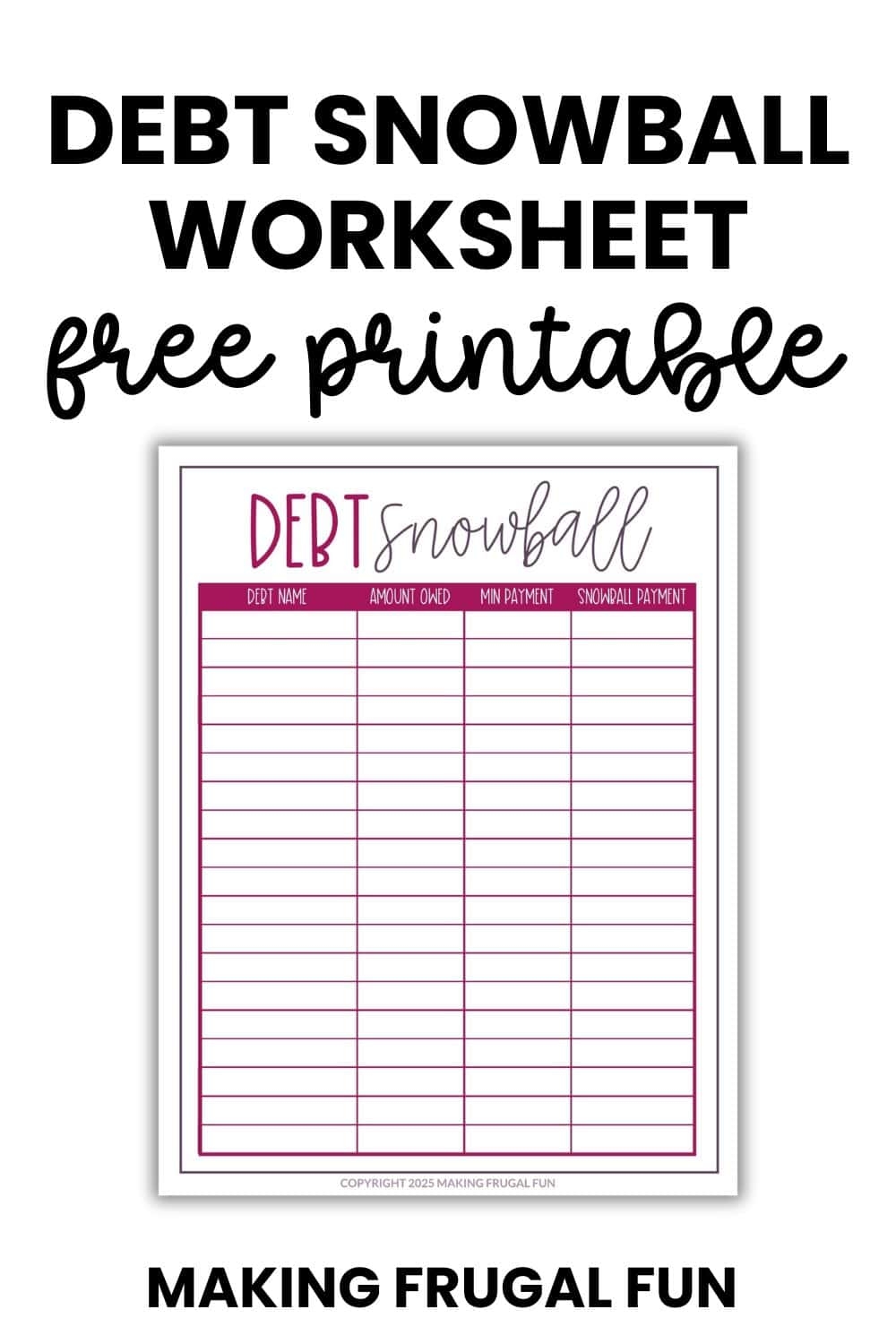

Free Printable Debt Snowball Worksheet Making Frugal FUN