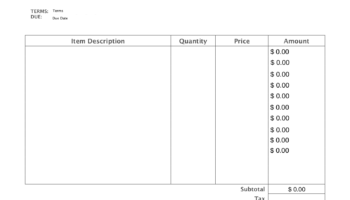

A document, often structured as a table, designed for recording financial transactions related to a checking account. These records typically include the date, description of the transaction, payment amount, deposit amount, and the resulting account balance. A physical version allows for manual record-keeping, while a digital format facilitates electronic tracking and printing for hard-copy maintenance. For example, an individual might use this ledger to note a grocery store purchase, the corresponding check number, and the updated balance in their account.

Maintaining a precise record of account activity offers several advantages, including facilitating budget management, identifying discrepancies or errors, and providing a historical audit trail for financial review. Historically, these ledgers were indispensable tools for personal and business finances, predating widespread adoption of digital banking systems. They remain valuable for those seeking a tangible means of overseeing their monetary flow and ensuring accuracy.

The subsequent sections will delve into the different types available, the optimal methods for utilization, and where one can acquire suitable templates for personalized account management.