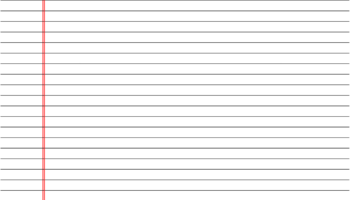

A readily accessible record-keeping tool, offered without cost, allows individuals to meticulously track financial transactions related to a checking account. Functioning as a manual ledger, it provides a space to document deposits, withdrawals, checks written, and electronic transfers, facilitating a clear understanding of account balances over time. Consider it the paper-based counterpart to the digital transaction history provided by financial institutions.

Maintaining a consistent and accurate log of banking activity offers numerous advantages. It empowers users to proactively monitor their finances, preventing overdraft fees and minimizing the risk of fraudulent activity. This practice has historical significance, predating widespread computerization, offering a reliable method for personal financial management. Such detailed records were once the standard, ensuring accountability and informed spending habits.

The following sections will examine the practical applications of these resources, exploring the variety of templates available, methods for effective utilization, and considerations for data security when handling sensitive financial information.