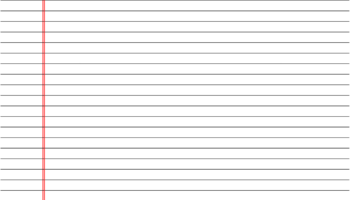

A readily available, physical record-keeping tool allows individuals to meticulously track financial transactions associated with a checking account. This resource typically presents in a tabular format, facilitating the documentation of deposits, withdrawals, fees, and the corresponding account balance after each transaction. An example includes a downloadable template designed for manual entry of banking activity, eliminating the necessity for specialized software.

The value of employing such a tool lies in its contribution to improved financial management. It provides a tangible method for reconciling bank statements, identifying discrepancies, and maintaining a clear understanding of one’s financial standing. Historically, physical registers were the primary method of tracking finances before the advent of digital banking and personal finance software, and they continue to offer a simple and reliable alternative or supplement to digital methods.

The subsequent discussion will delve into the various templates available, their features, how to effectively utilize these resources, and considerations for selecting the most appropriate option to meet individual budgeting and financial tracking needs.