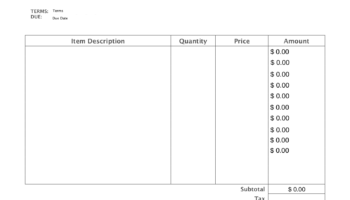

A physical record for tracking financial transactions, especially those made via checks, is a crucial tool for personal and small business accounting. This record, when designed with ample space for entries, offers a tangible means of managing income and expenses. For example, an individual might use such a form to monitor their monthly budget, noting each check written, deposit made, and resulting account balance.

Maintaining accurate records of financial activity offers several advantages. It allows for easy reconciliation with bank statements, helping to identify discrepancies and prevent errors. This practice also supports informed financial decision-making, providing a clear overview of spending patterns and available funds. Historically, these paper-based systems were the primary method for individuals and organizations to maintain control over their finances before the advent of widespread digital banking tools.

The following sections will delve into the specific benefits of utilizing a physical accounting method, explore different layout options optimized for ease of use, and examine strategies for integrating these records into a broader financial management system.