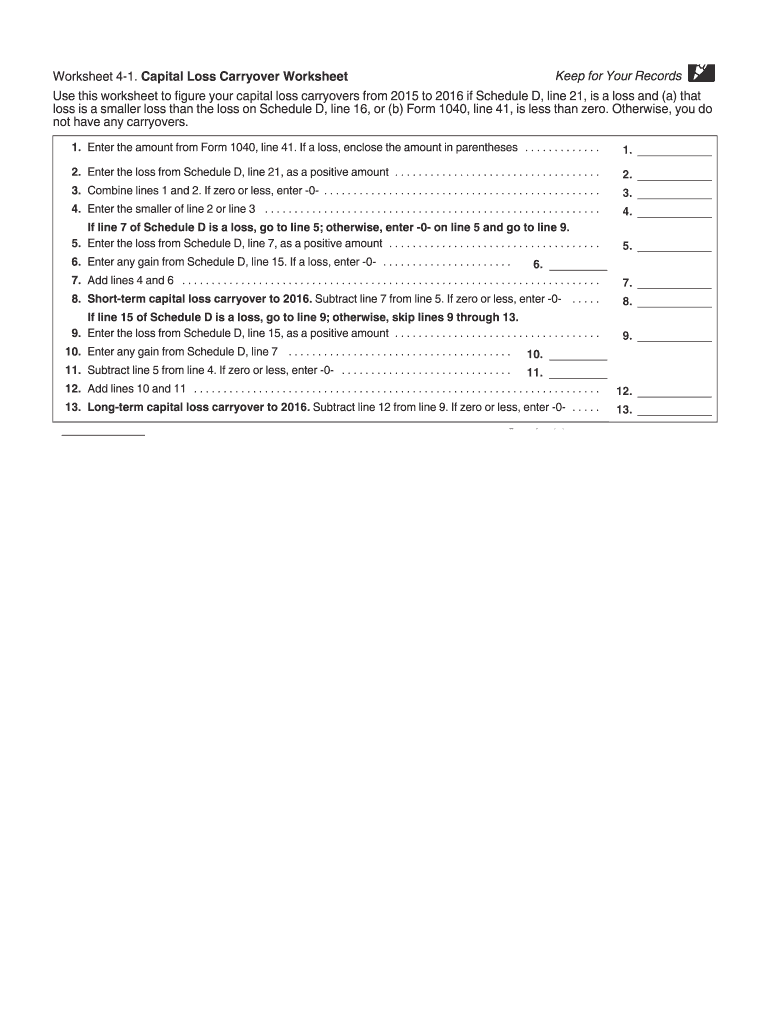

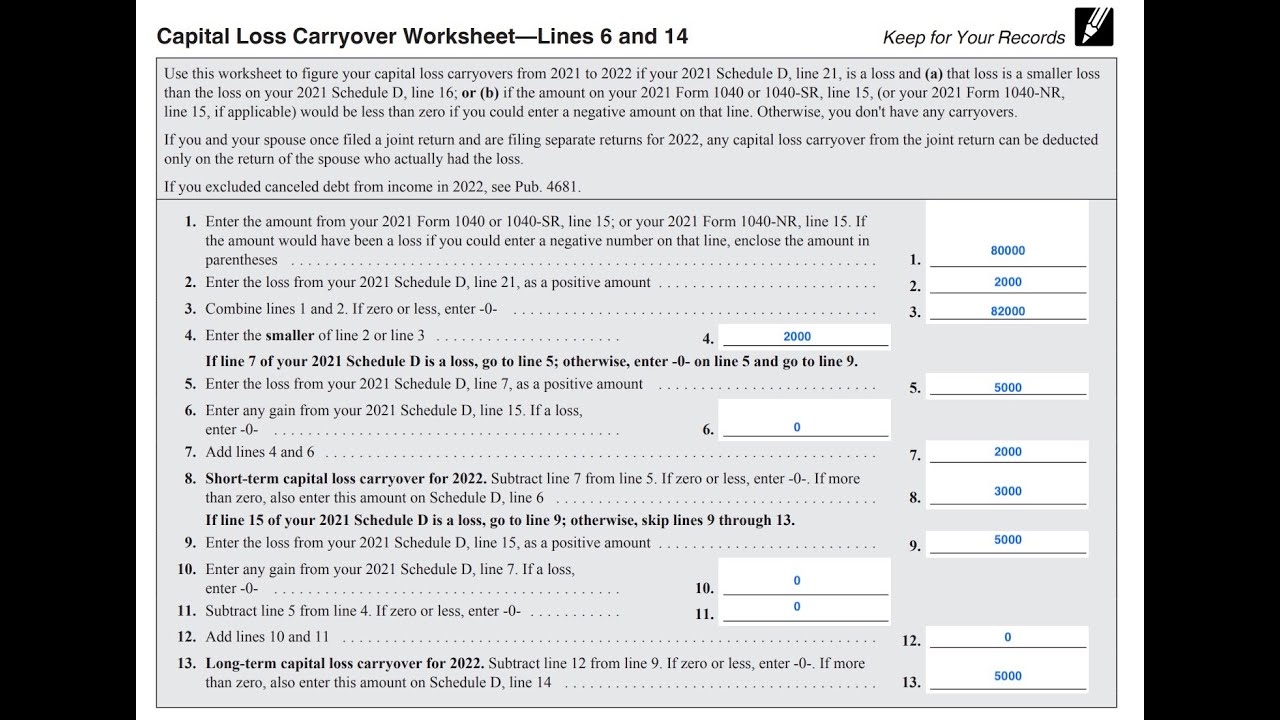

Are you looking for information on how to calculate your capital loss carryover? Understanding the capital loss carryover worksheet can help you manage your taxes and potentially save you money in the long run.

When you sell an asset for less than you paid for it, you incur a capital loss. This loss can be used to offset capital gains in future years through a capital loss carryover worksheet.

capital loss carryover worksheet

Maximizing Your Tax Benefits with a Capital Loss Carryover Worksheet

The capital loss carryover worksheet allows you to keep track of your unused capital losses from previous years. By utilizing this worksheet, you can reduce your tax liability and potentially receive a refund if you have more losses than gains.

It’s important to accurately fill out the capital loss carryover worksheet to ensure you are maximizing your tax benefits. Make sure to consult with a tax professional if you have any questions or need assistance with the process.

By carrying over your capital losses strategically, you can make the most of your investment portfolio and minimize your tax burden. Take advantage of the capital loss carryover worksheet to optimize your tax planning and financial strategy.

In conclusion, understanding how to use a capital loss carryover worksheet is essential for managing your taxes effectively. By keeping track of your capital losses and gains, you can make informed decisions that benefit your financial future.

Capital Loss Carryover Worksheet Example In Powerpoint And Google Slides Cpb PPT Presentation

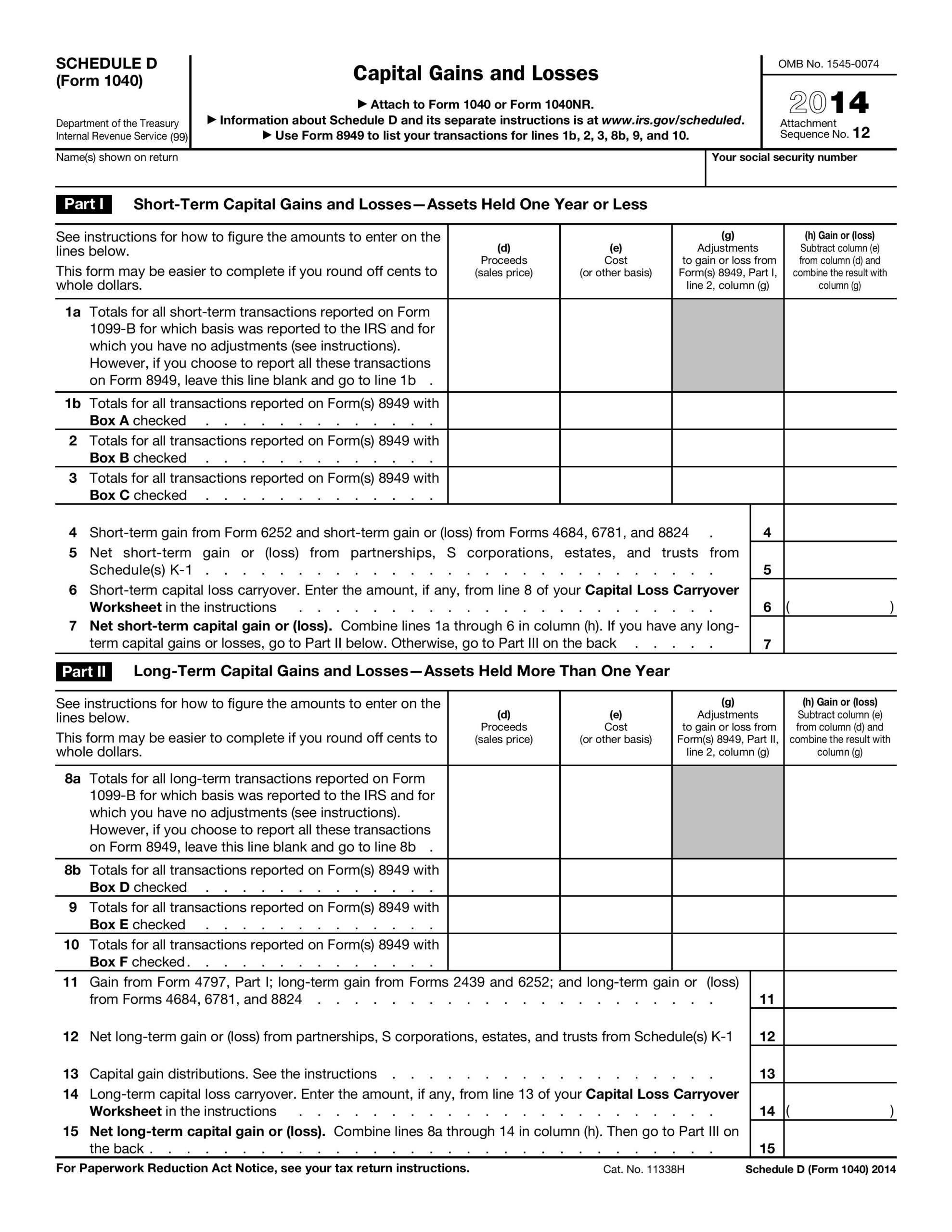

IRS Schedule D Instructions Capital Gains And Losses

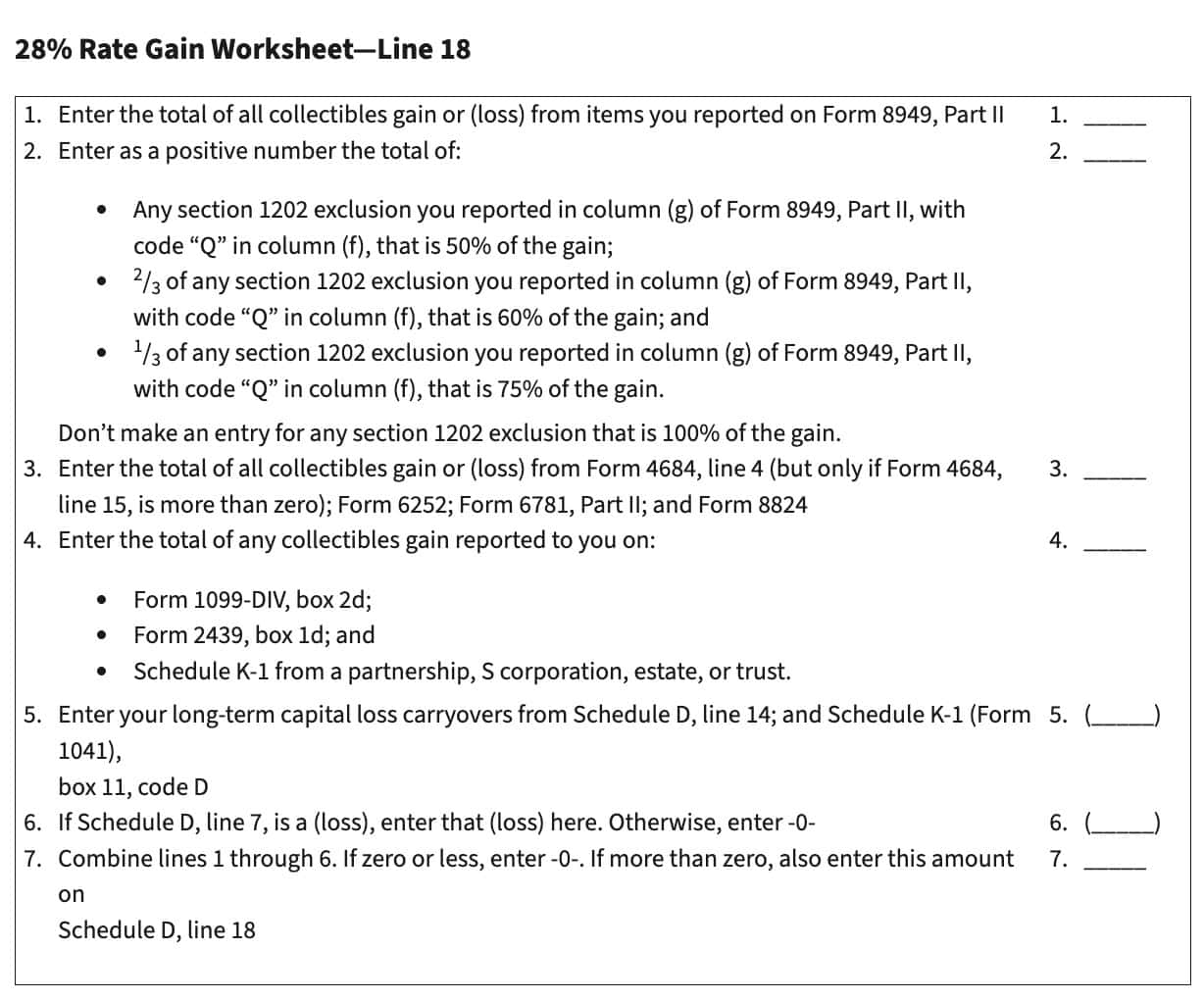

How To Minimize Portfolio Taxes Worksheets Library

2018 2024 Form IRS Capital Loss Carryover Worksheet Fill Online Worksheets Library

Schedule D Capital Loss Carryover Worksheet Walkthrough Lines 6 14 YouTube