Are you looking to better understand qualified dividends and capital gain tax worksheet? It can be a confusing topic, but don’t worry, we’re here to break it down for you in simple terms.

Qualified dividends are dividends paid by a corporation that meet certain criteria set by the IRS. These dividends are taxed at a lower rate than ordinary dividends, which can save you money on your tax bill.

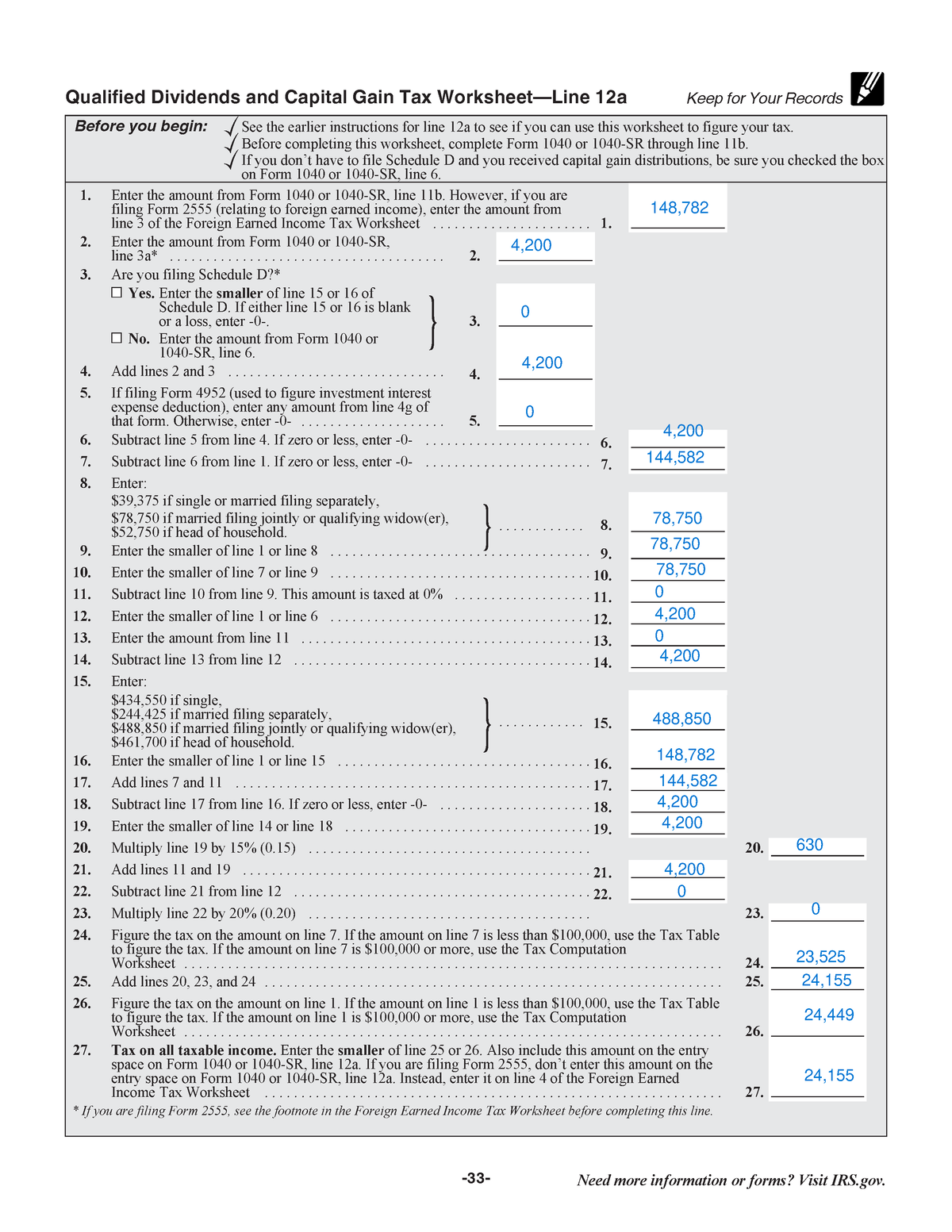

qualified dividends and capital gain tax worksheet

Understanding the Qualified Dividends and Capital Gain Tax Worksheet

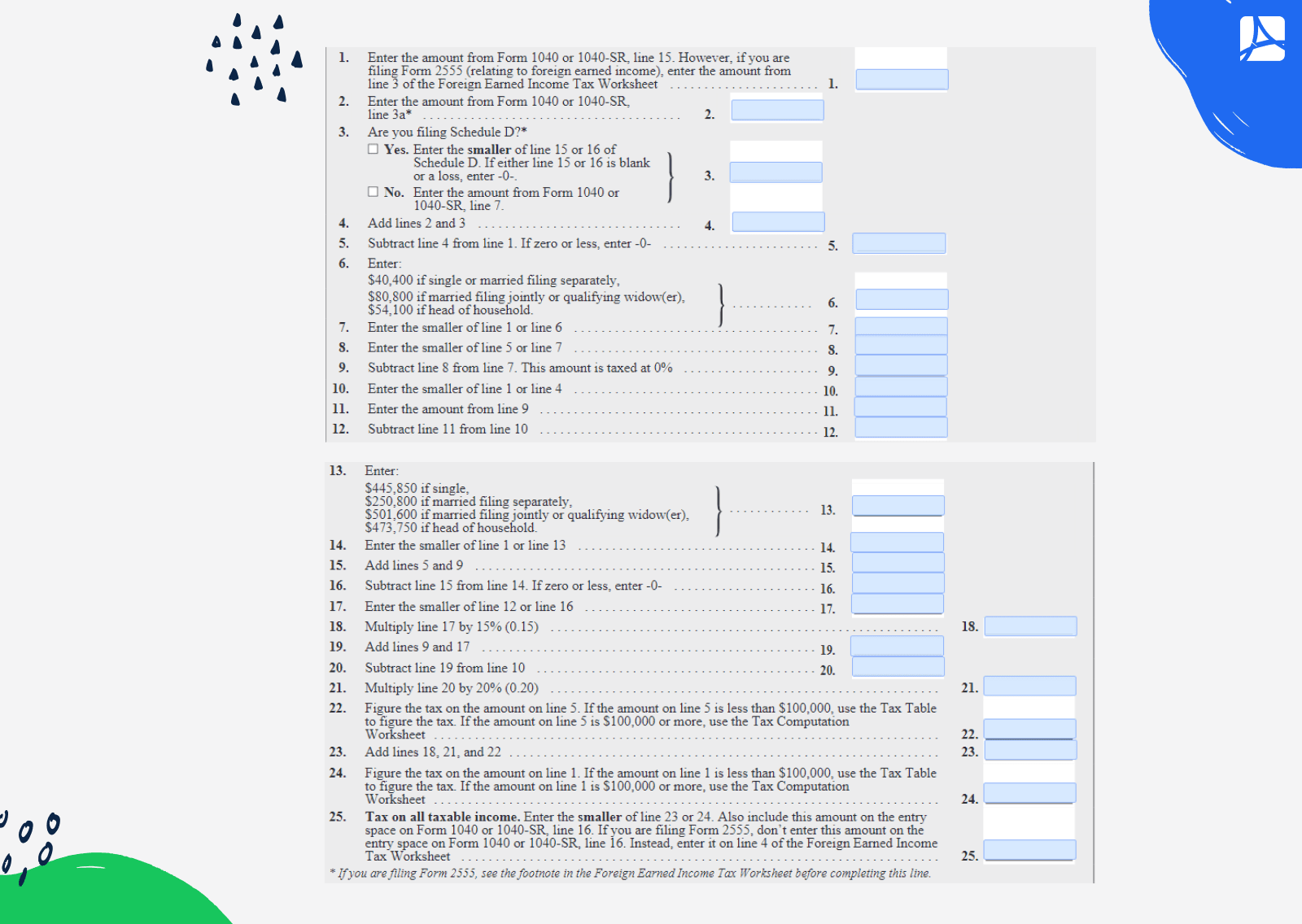

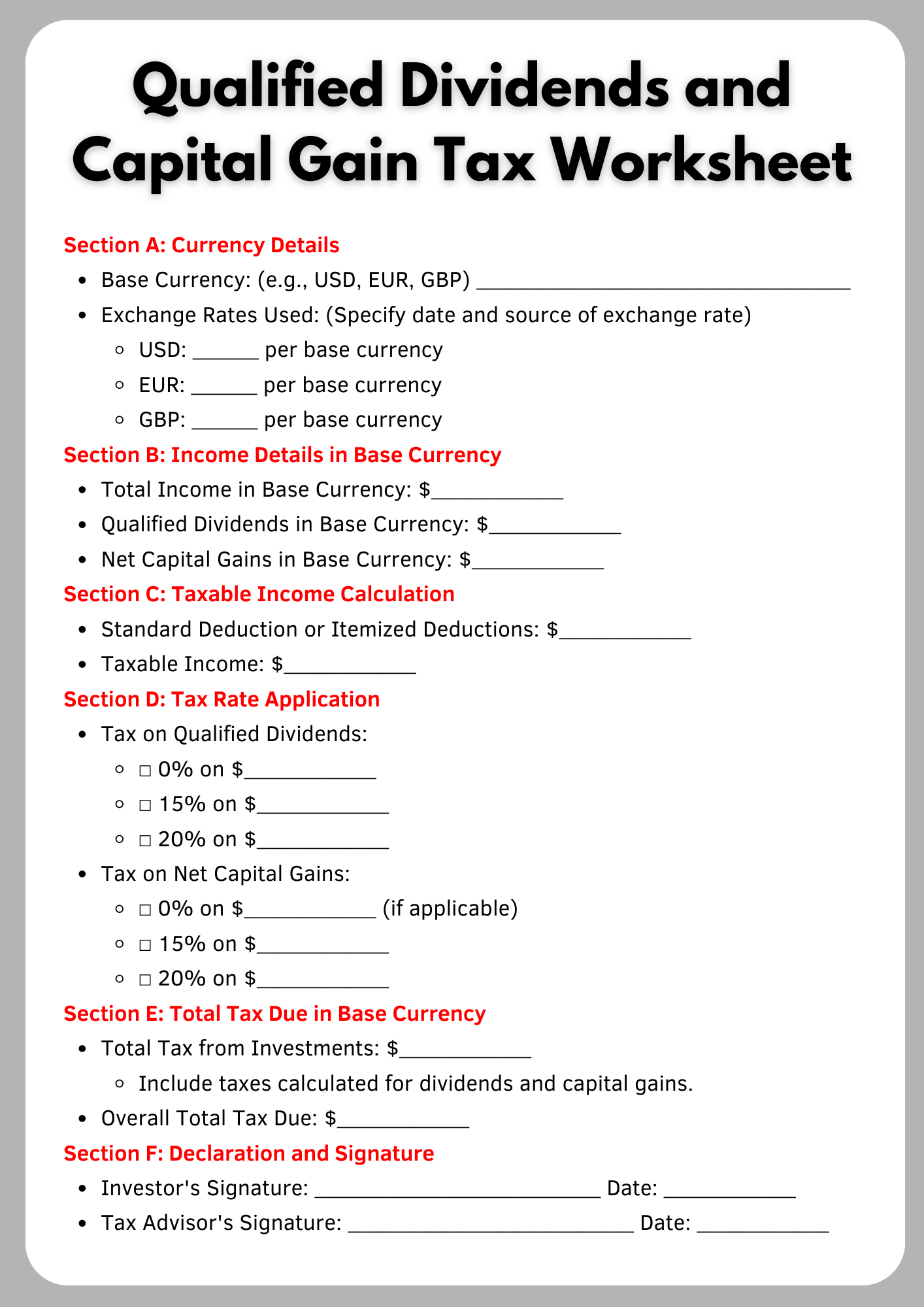

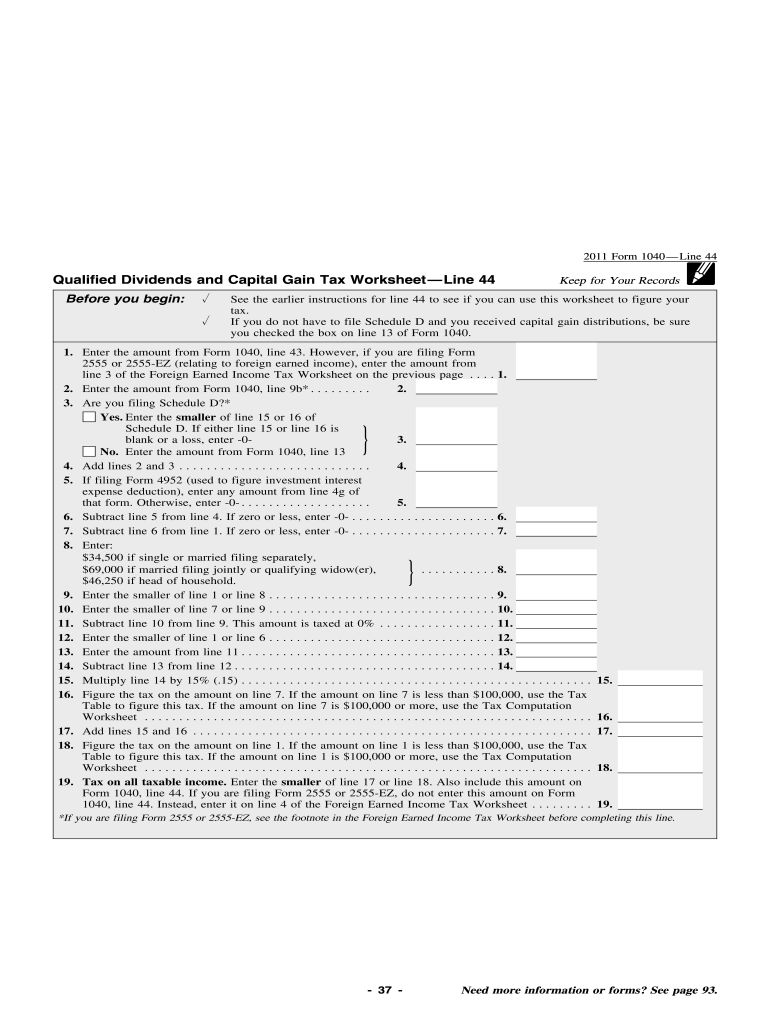

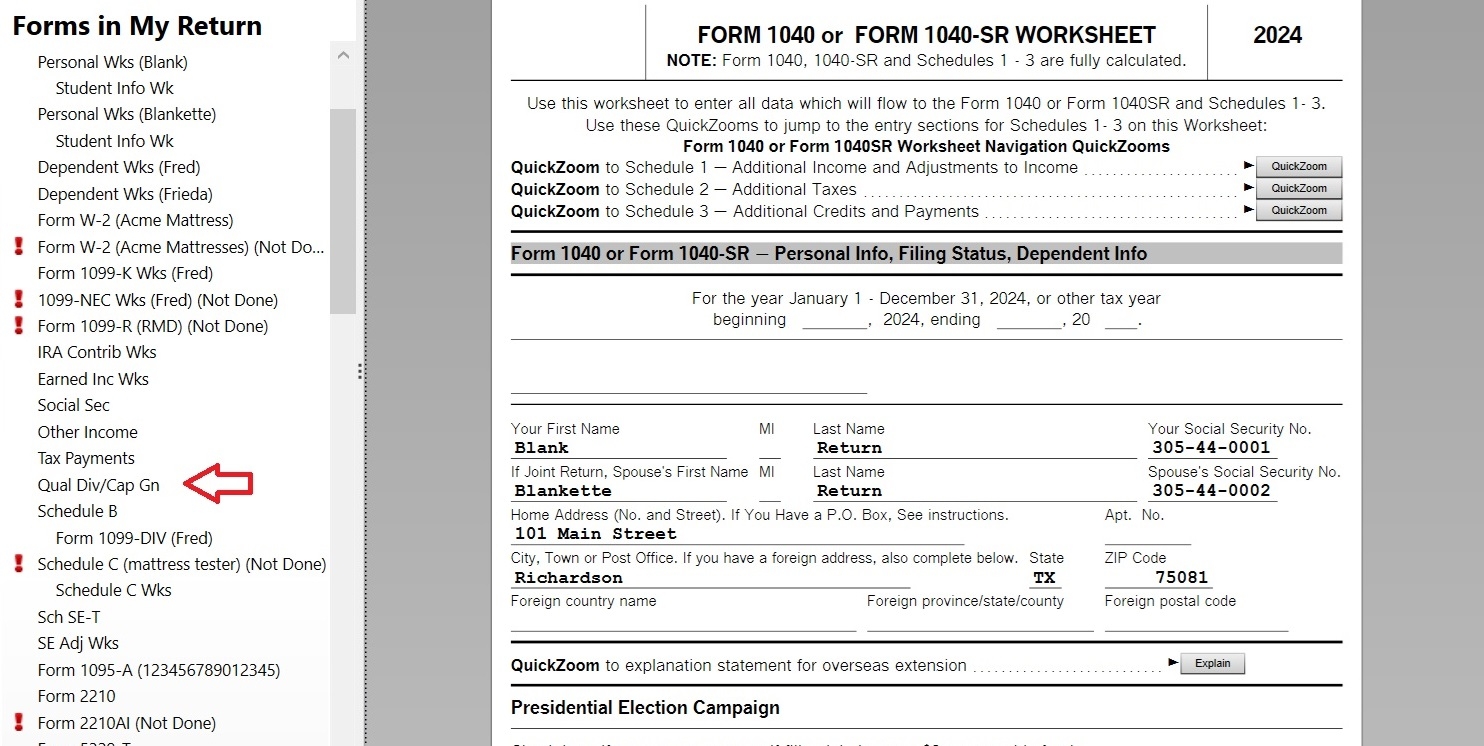

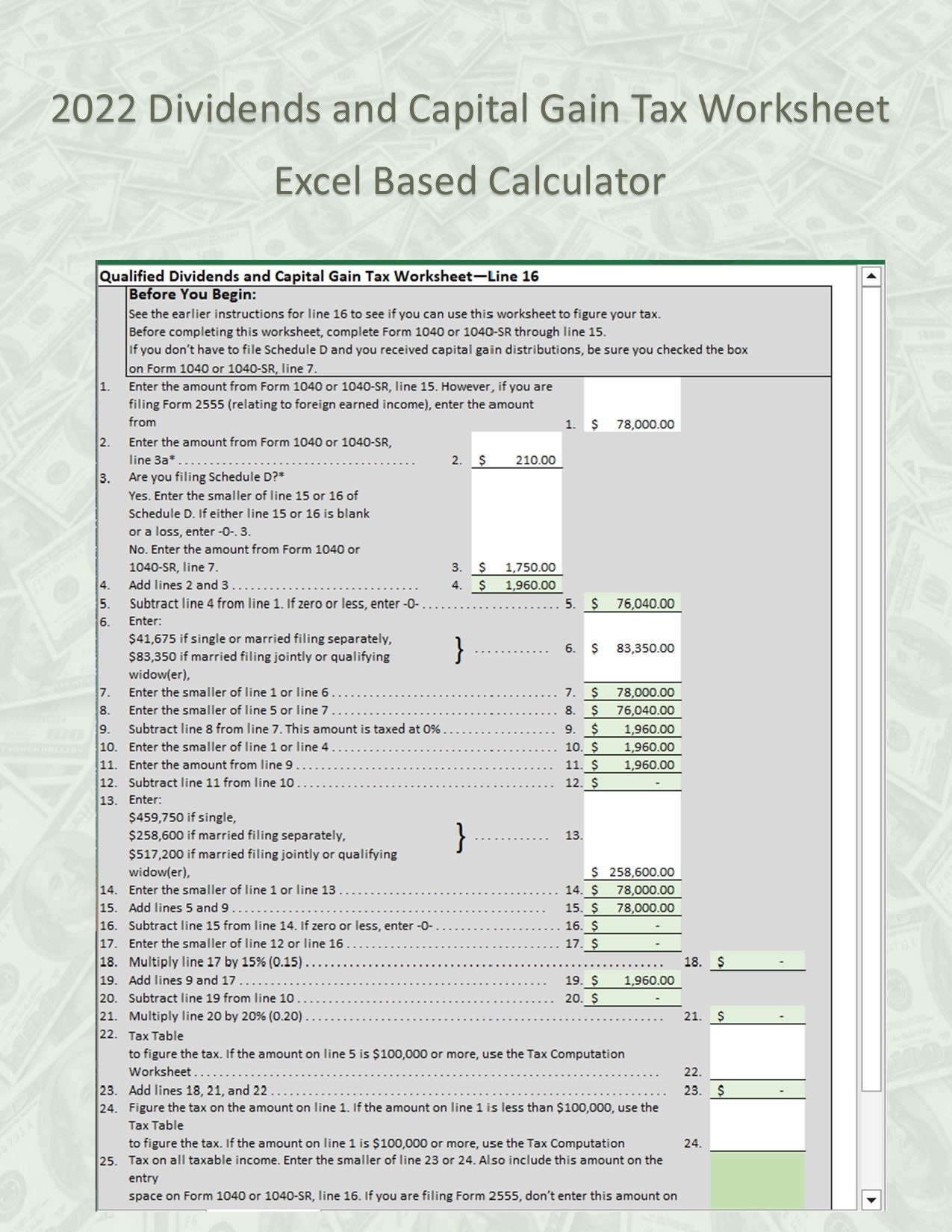

When it comes to filling out the qualified dividends and capital gain tax worksheet, it’s important to gather all the necessary information, including the amount of dividends you received and any capital gains you realized during the tax year.

Next, you’ll need to calculate the tax on your qualified dividends and capital gains using the worksheet provided by the IRS. This will help you determine the correct amount of tax you owe on these types of income.

Remember to double-check your calculations and consult with a tax professional if you have any questions or concerns. Filling out the qualified dividends and capital gain tax worksheet correctly can help you minimize your tax liability and keep more money in your pocket.

In conclusion, understanding qualified dividends and capital gain tax worksheet doesn’t have to be overwhelming. By following the IRS guidelines and seeking assistance when needed, you can navigate this process with confidence and ease.

40 Free Printable Qualified Dividends And Capital Gain Tax Worksheet Samples To Download In PDF

Qualified Dividends And Capital Gains Worksheet 2023 Fill Out Worksheets Library

Solved Qualified Dividends And Capital Gain Tax Worksheet Missing

Qualified Dividends And Capital Gains Worksheet Page 33 Of 108 Worksheets Library

Easy Calculator For 2022 Qualified Dividends And Capital Gain Tax Worksheet excel 2016 Also Includes Tax Computation Worksheet Etsy