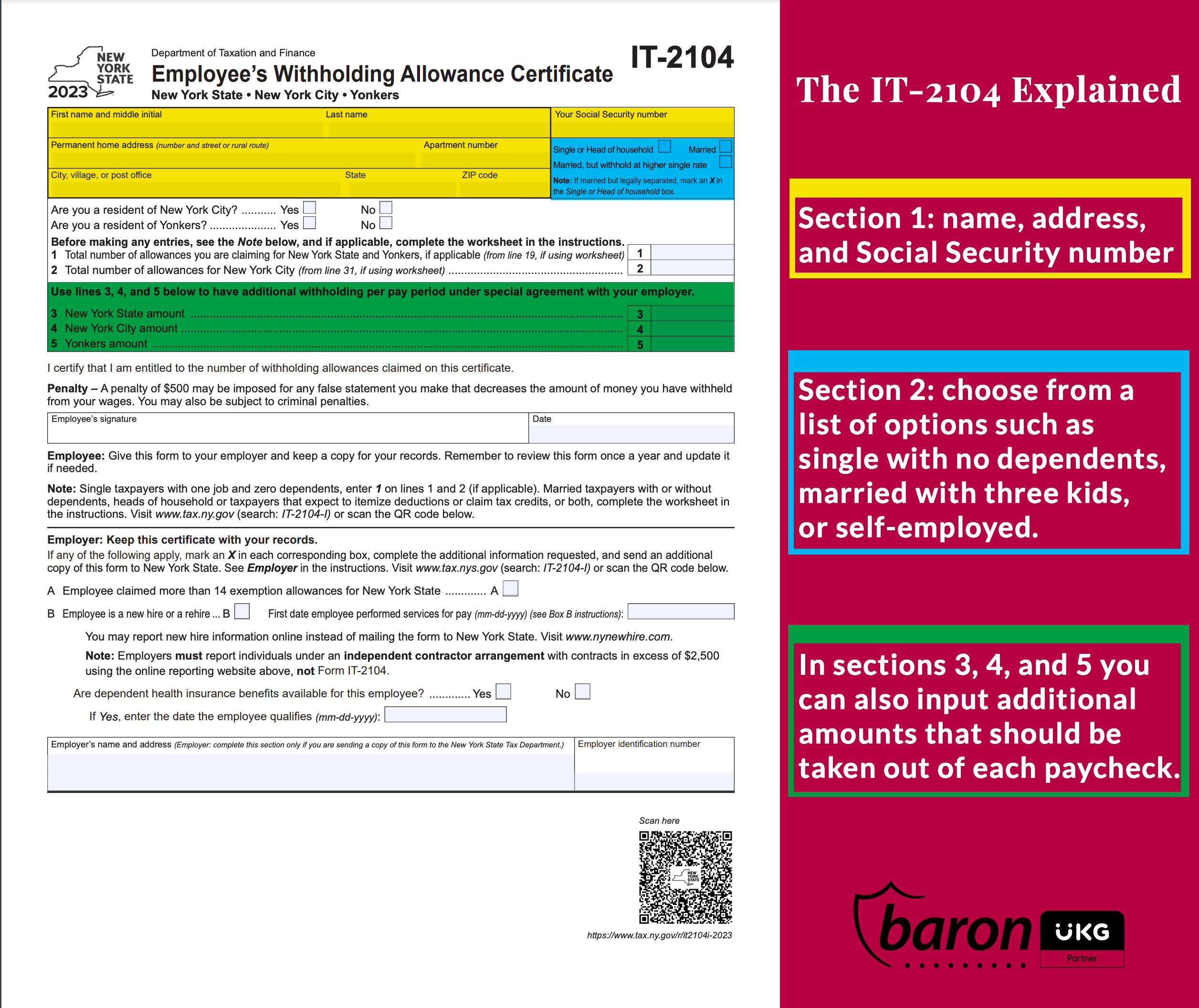

Are you confused about how to fill out your IT-2104 worksheet? Don’t worry, we’ve got you covered! Understanding tax forms can be tricky, but we’re here to break it down for you in simple terms.

The IT-2104 worksheet is a document used by employers to determine how much income tax should be withheld from your paycheck. It takes into account factors like your filing status, number of dependents, and any additional withholdings you may have.

it-2104 worksheet

Demystifying the IT-2104 Worksheet

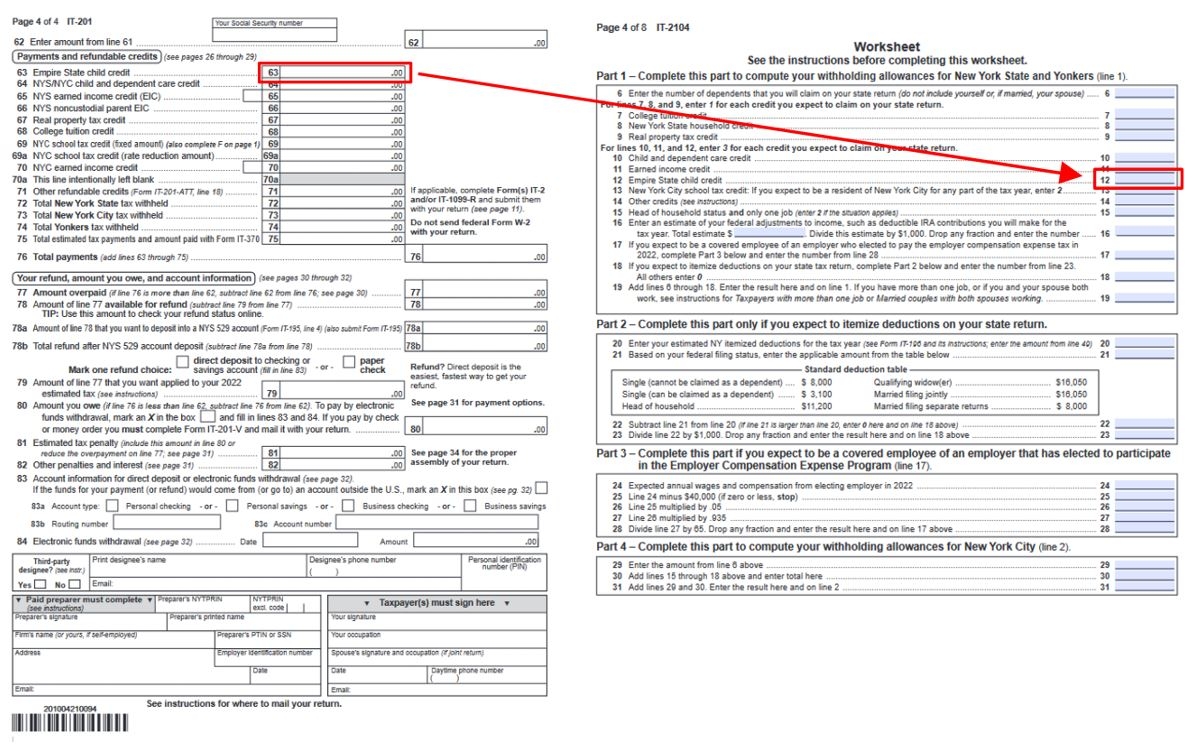

Start by filling out the top section of the worksheet with your personal information. Then, move on to the sections that calculate your allowances based on your filing status and dependents. Be sure to follow the instructions carefully to avoid any errors.

If you have multiple jobs or sources of income, you may need to adjust your withholdings to ensure you’re not underpaying or overpaying taxes. The worksheet provides guidance on how to make these adjustments based on your specific situation.

Once you’ve completed the worksheet, review it carefully to make sure all the information is accurate. If you have any questions or need assistance, don’t hesitate to reach out to a tax professional for help. It’s better to get it right the first time than to deal with tax issues later on.

Understanding the IT-2104 worksheet may seem daunting at first, but with a little guidance, you’ll be able to navigate it with ease. Remember, it’s important to stay informed about your tax obligations to avoid any surprises come tax season. Happy tax filing!

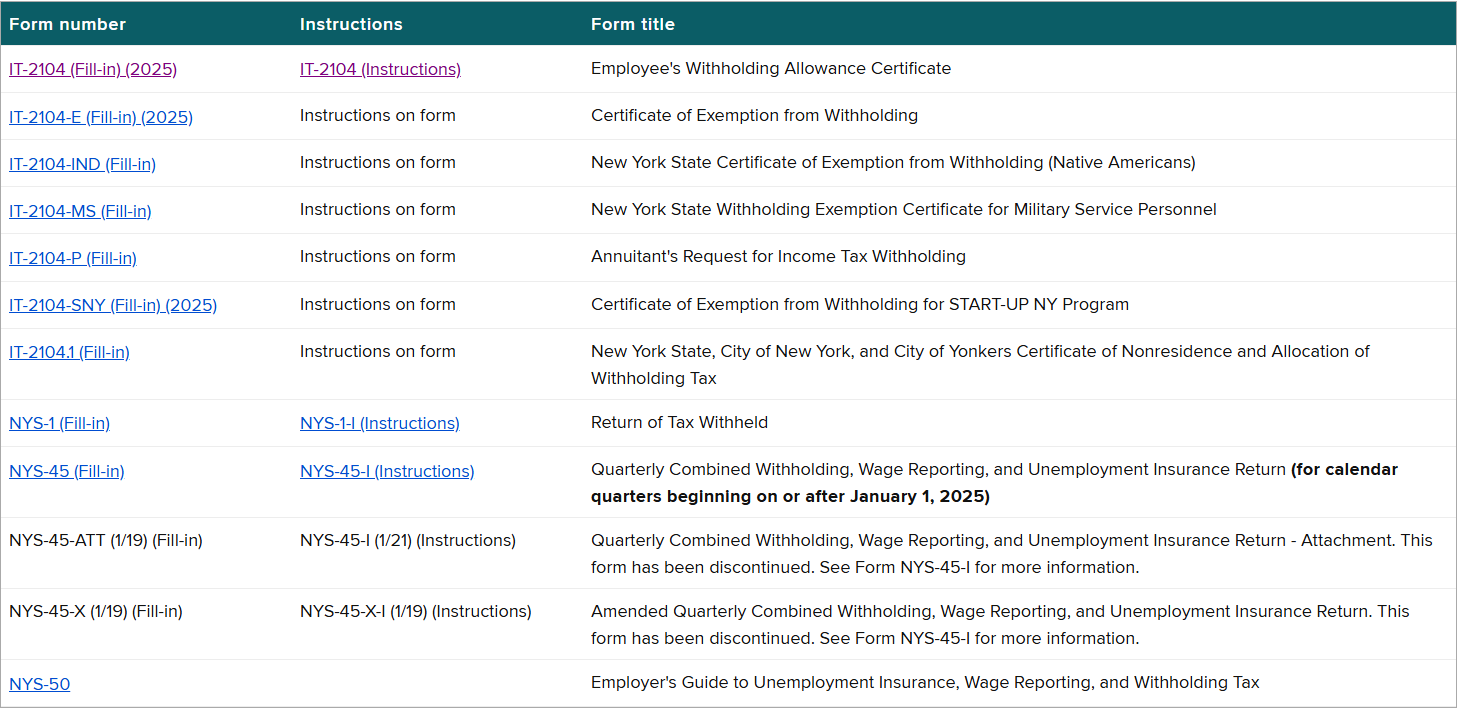

Tips And Reminders Form IT 2104 Employees Withholding Allowance Worksheets Library

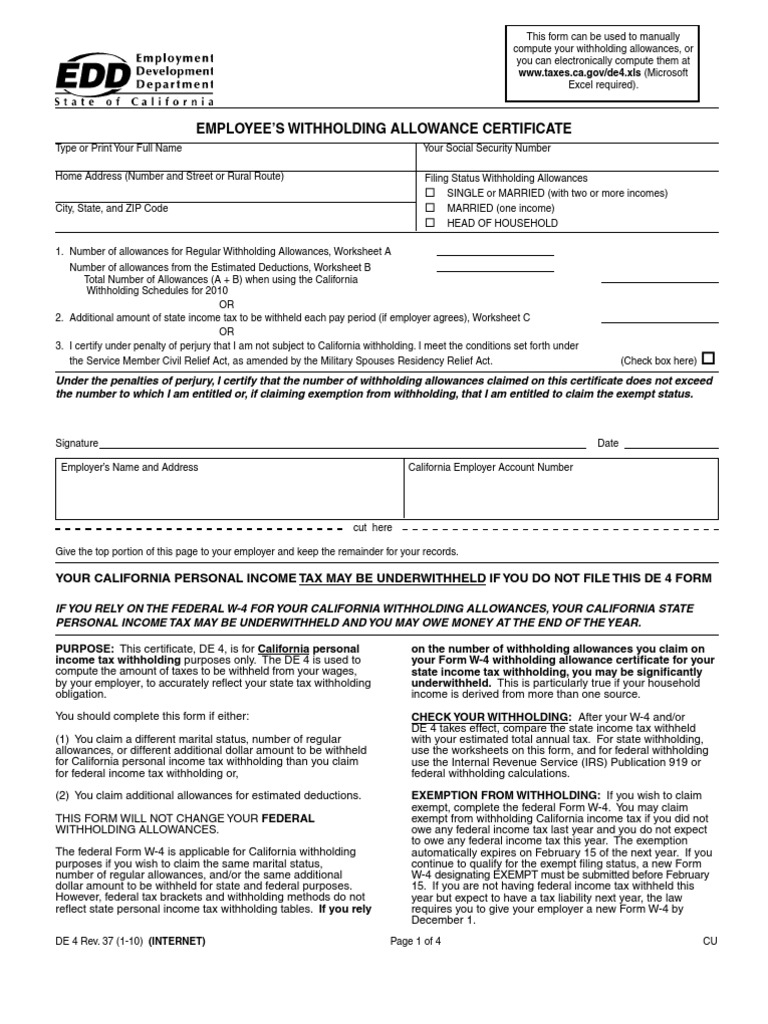

Guide To NY State Form IT 2104 2025

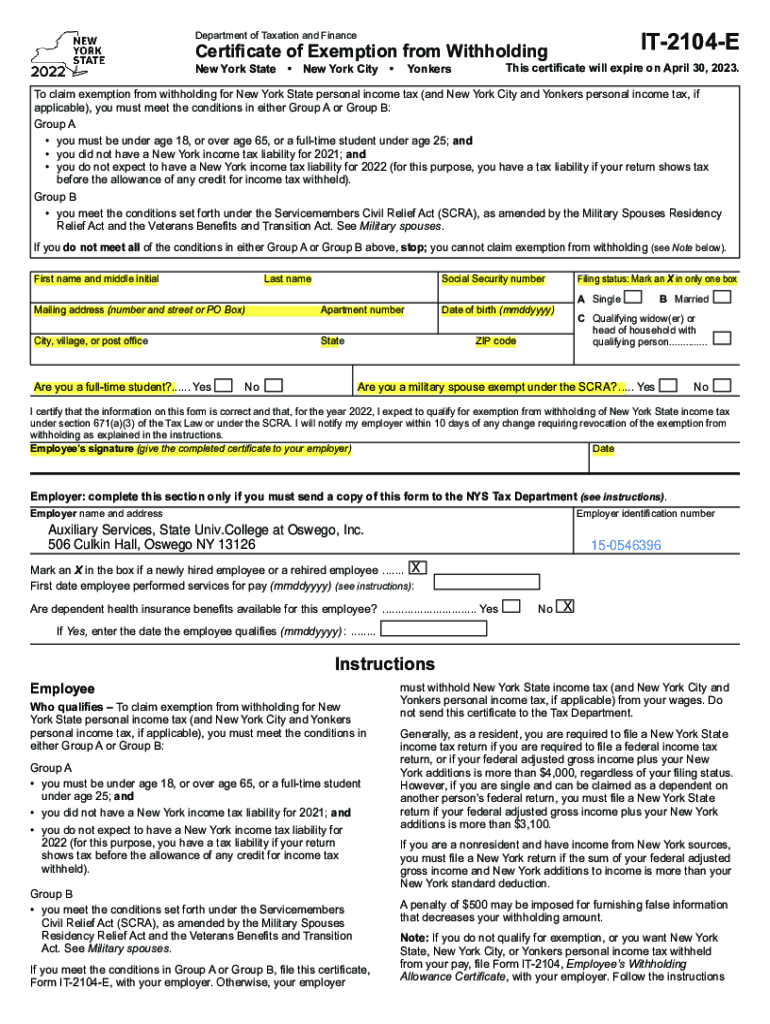

Certificate Of Exemption From Withholding Fill Online Printable Fillable Blank PdfFiller

IT 2104 Step by Step Guide Baron Payroll

Tips And Reminders Form IT 2104 Employee s Withholding Allowance Certificate