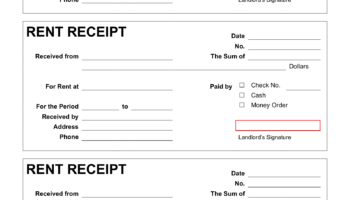

A physical record used to reconcile the actual cash present in a register at the end of a business day with the expected amount based on sales transactions. It typically includes fields for starting cash, cash received, cash spent, and the final cash balance, allowing for documentation of any discrepancies. This written document, often pre-formatted for ease of use, is designed to be physically printed and completed manually.

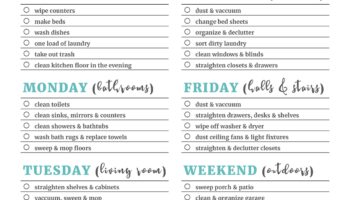

The practice ensures financial accountability and helps prevent internal theft or unintentional errors in cash handling. Regular implementation facilitates accurate financial reporting, simplifies audits, and provides a clear audit trail for cash transactions. The systematic approach stems from a long-standing need for retail businesses to maintain precise financial records and manage their cash assets effectively.

This article will delve into the practical applications, design considerations, and best practices for implementing an effective cash reconciliation process. It will explore the essential elements of form design, techniques for accurate counting, and strategies for resolving discrepancies when they arise.