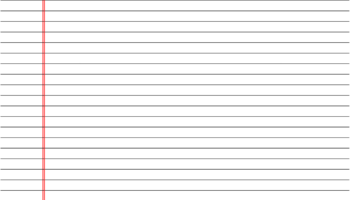

A record-keeping tool, often formatted as a table, that enables individuals to track financial transactions associated with a checking account without incurring any cost for the physical form itself. This document typically includes columns for dates, transaction descriptions, payment amounts, deposit amounts, and running balances. Using one, for example, allows a person to manually monitor expenditures and income, helping ensure that account balances align with bank records and prevent overdrafts.

Maintaining a meticulous account of banking activity offers several advantages. It facilitates budget management, providing a clear view of cash flow and spending patterns. Historically, these ledgers were the primary method for balancing accounts before the advent of digital banking. Even with sophisticated online tools available, the physical record offers a tangible backup and can be particularly useful for those who prefer a manual approach to financial oversight. Furthermore, this practice supports early detection of errors or unauthorized transactions, thus safeguarding against potential financial loss.

The subsequent sections will delve into the various templates available for download, methods for effectively utilizing these financial management tools, and considerations for selecting the most suitable format based on individual needs and preferences.