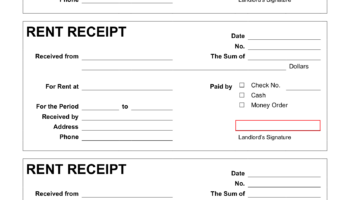

A budgeting tool, often in a table or checklist format, designed for individuals to record and monitor their recurring and one-time expenses. These resources typically include fields for due dates, amounts owed, payment status, and confirmation numbers. Their readily available format enables convenient access and personal record-keeping.

Diligent monitoring of financial obligations provides several advantages. It promotes financial awareness, facilitates timely payments, reduces the risk of late fees and penalties, and contributes to improved credit scores. Early forms of these resources were hand-drawn or created using rudimentary spreadsheet software; contemporary versions are frequently available as pre-designed templates for immediate use.

The subsequent sections will address the practical applications of expense management tools, the different types available, and how to effectively use such resources to achieve financial stability and budgeting goals.