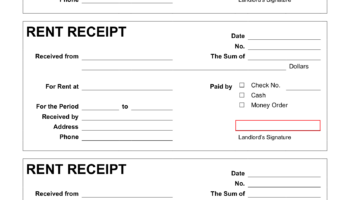

A readily available, complimentary resource designed to aid in monitoring and managing financial obligations. This tool typically takes the form of a document, often downloadable or printable, that allows individuals to record due dates, amounts owed, and payment statuses for various invoices and recurring expenses. It serves as a basic organizational system to keep track of one’s financial commitments, such as rent, utilities, loans, and subscriptions.

The utility of such a tool lies in its ability to prevent late payments, minimize associated fees, and contribute to a more accurate understanding of one’s financial position. By providing a centralized location for tracking expenses, it promotes financial awareness and facilitates proactive budget management. Historically, these tools have evolved from handwritten ledgers to digital spreadsheets, and now include downloadable templates that offer enhanced accessibility and ease of use for those seeking to manage their finances without incurring software costs.

The following sections will delve into the key features, benefits, and practical applications of utilizing these resources for effective personal finance management. Information on sourcing and customising these templates will also be covered.