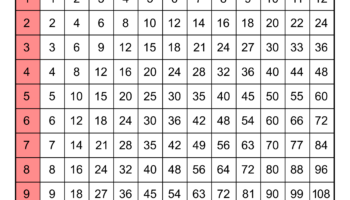

A structured, year-long savings plan visually represented, often on a sheet designed for easy tracking, facilitates incremental accumulation of funds. This tool typically outlines a specific amount to save each week, progressively increasing the sum over the 52-week period. For example, one version might start with saving \$1 in week one, \$2 in week two, and so on, until reaching \$52 in the final week, culminating in a total savings of \$1,378.

The advantage of employing such a method lies in its simplicity and gradual approach, making saving seem less daunting, particularly for individuals new to budgeting or those seeking to establish consistent savings habits. Historically, these structured savings plans have gained traction as accessible alternatives to more complex financial strategies, providing a tangible means to achieve savings goals. The tangible nature of the tracking sheet provides visual reinforcement and motivation throughout the year.

The subsequent sections will explore the various adaptations of this systematic approach, detailing how to effectively implement a plan, personalize it to suit individual financial circumstances, and maximize its potential for achieving diverse monetary objectives.