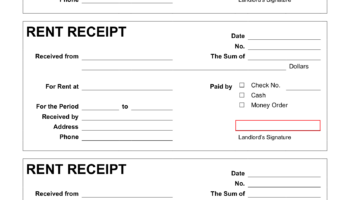

A readily available document, designed for personal finance management, facilitates the systematic recording of recurring expenditures. This resource typically includes columns for date, payee, amount due, amount paid, and notes, enabling users to track their obligations. For example, an individual could utilize such a form to monitor payments for utilities, rent, and credit card bills, ensuring no due date is missed.

The use of these financial trackers offers numerous advantages, primarily increased awareness of spending habits and improved budgetary control. By diligently documenting outgoing funds, users gain a clearer picture of their cash flow, allowing for informed financial decision-making. Historically, individuals relied on handwritten ledgers for similar purposes; the advent of readily accessible, customizable templates has simplified this process, making it more efficient and user-friendly. The availability of such resources promotes financial literacy and responsibility.

The following sections will delve into the practical aspects of acquiring and effectively utilizing these record-keeping tools, discussing features to look for, customization options, and strategies for seamless integration into existing financial management routines.