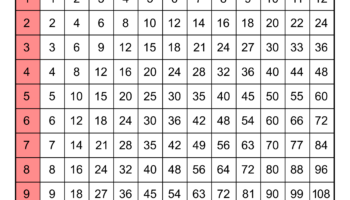

A structured savings plan, often presented in a visual format suitable for printing, assists individuals in accumulating a specific sum, in this case, $10,000. This tool typically outlines a series of incremental deposit targets over a defined period, providing a roadmap for achieving the desired financial goal. An example might involve saving increasing amounts each week, such as $10 in week one, $20 in week two, and so forth, until the cumulative total reaches the target.

Such a systematic approach offers several advantages. It can foster financial discipline, provide a tangible sense of progress, and make a significant savings goal seem less daunting. The practice of setting and achieving smaller milestones can boost motivation and encourage consistent saving behavior. Historically, similar methods have been employed in various cultures to promote thrift and financial security, adapting to different economic contexts and personal circumstances.

The following sections will delve into specific strategies for utilizing this savings method effectively, explore variations designed to suit different financial situations, and provide guidance on selecting or creating a plan that aligns with individual needs and preferences. Furthermore, resources and tools for tracking progress and maintaining commitment will be discussed.