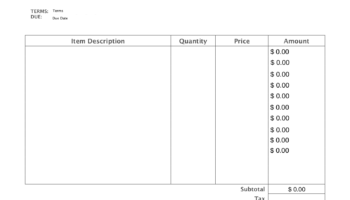

A complimentary, readily available document designed for tracking vehicle travel distances and related details, commonly saved in a portable document format, is a practical tool for record-keeping. These forms often include fields for date, destination, purpose of travel, starting and ending odometer readings, and total miles driven. An example of its utility is for small business owners who need to track trips for tax deductions or for employees who need to be reimbursed for business-related travel.

Accurate tracking of vehicular distances offers numerous advantages, particularly in financial and administrative contexts. Businesses and individuals may utilize this data for expense reimbursement, tax deductions related to business or charitable use of a vehicle, and general cost management. Historically, manual record-keeping was the norm, but the advent of digital tools has streamlined this process, yet printable logs remain a valuable, accessible option, especially in situations where digital access is limited or a physical record is preferred.

The subsequent sections will delve into the specific use cases, types, and considerations associated with utilizing readily accessible travel distance documentation, providing a comprehensive overview for effective record-keeping and compliance.