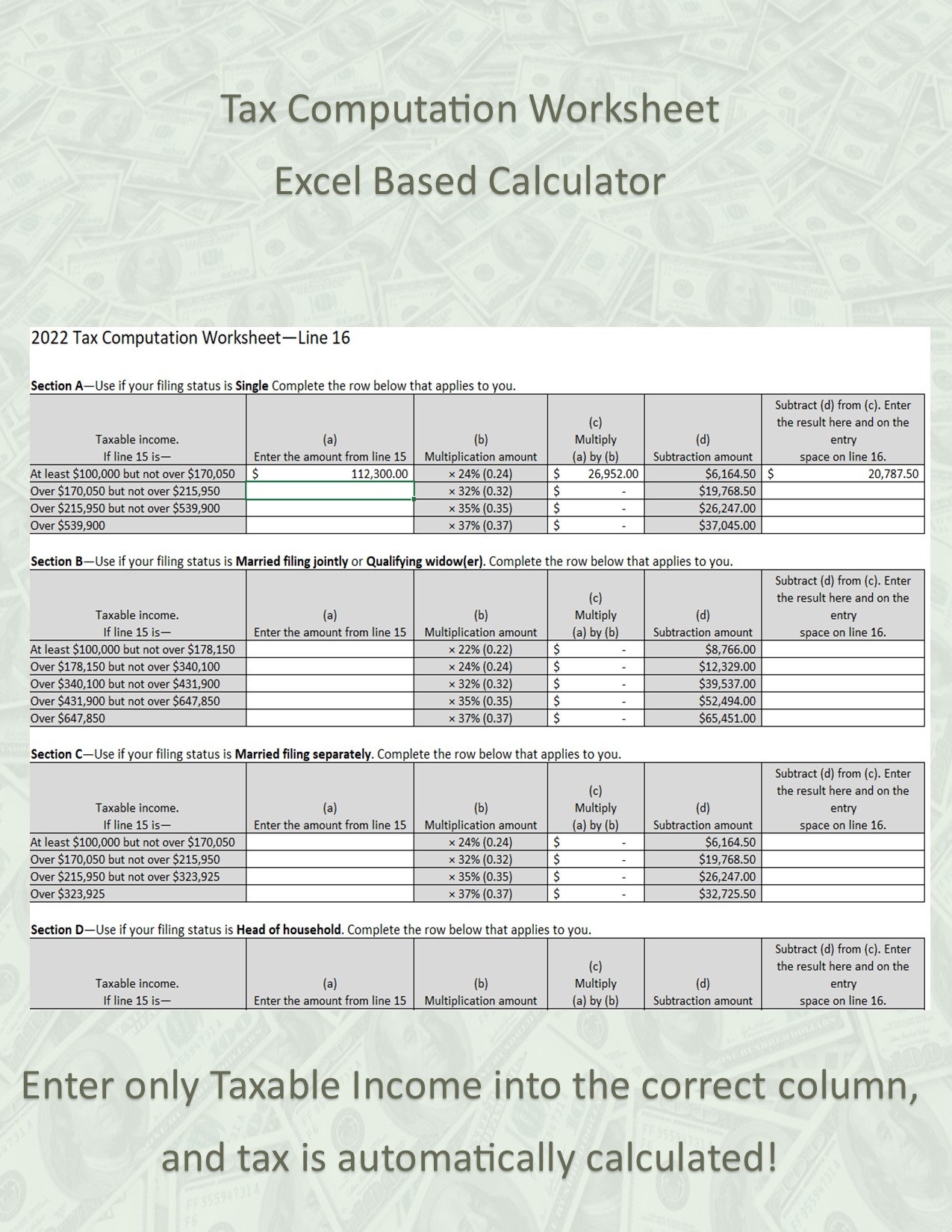

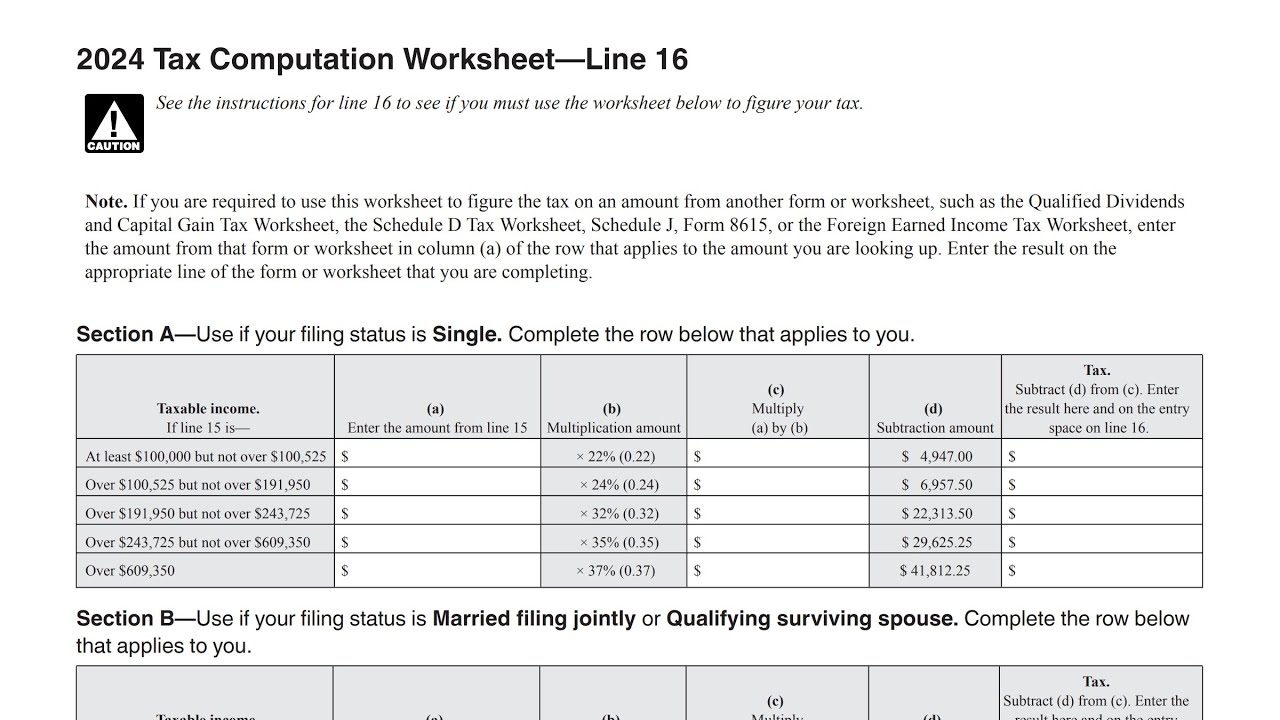

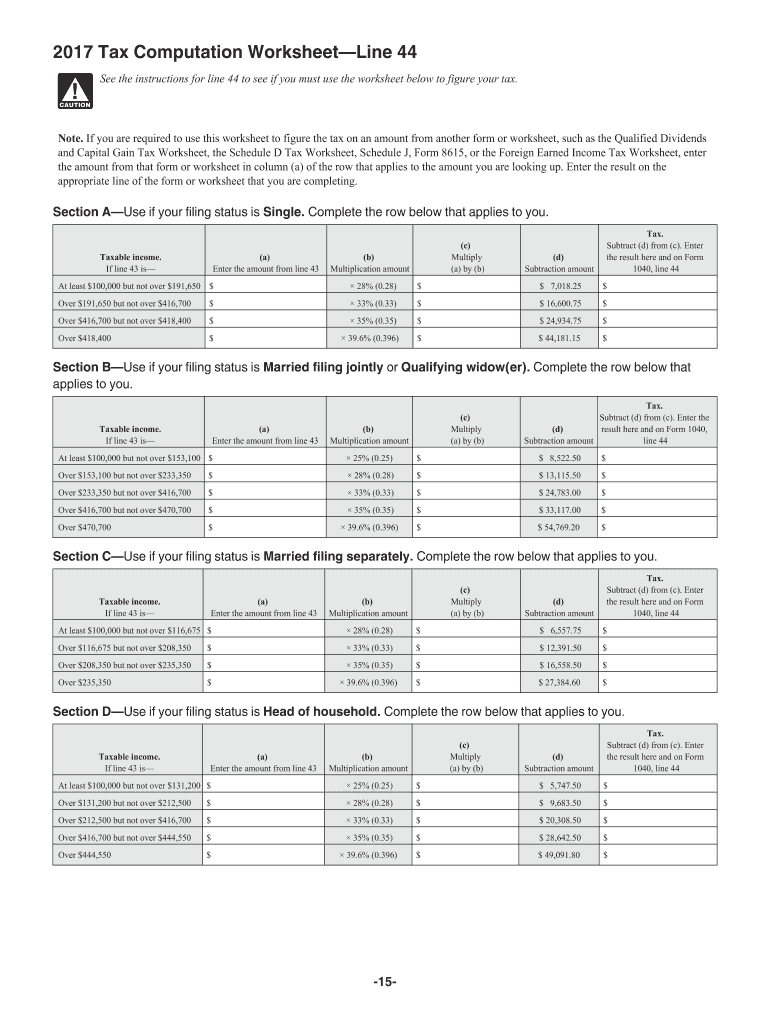

Are you looking for an easy way to calculate your taxes? One useful tool that can help you with this task is a tax computation worksheet. This worksheet is a simple document that provides a step-by-step guide to help you determine your tax liability.

By using a tax computation worksheet, you can input your income, deductions, and credits to calculate your total tax owed. This tool can be especially helpful if you have multiple income sources or complicated tax situations. It can also help you identify any potential tax savings opportunities.

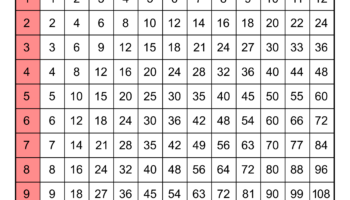

tax computation worksheet

The Benefits of Using a Tax Computation Worksheet

One of the main benefits of using a tax computation worksheet is that it can help you organize your financial information in a clear and structured manner. This can make it easier for you to understand your tax situation and ensure that you are taking advantage of all available tax deductions and credits.

Additionally, a tax computation worksheet can help you avoid errors in your tax calculations. By following the step-by-step instructions provided in the worksheet, you can ensure that you are accurately reporting your income and deductions, which can help you avoid costly mistakes on your tax return.

In conclusion, using a tax computation worksheet can simplify the process of calculating your taxes and help you maximize your tax savings. So next time you are preparing your taxes, consider using a tax computation worksheet to make the process easier and more efficient.

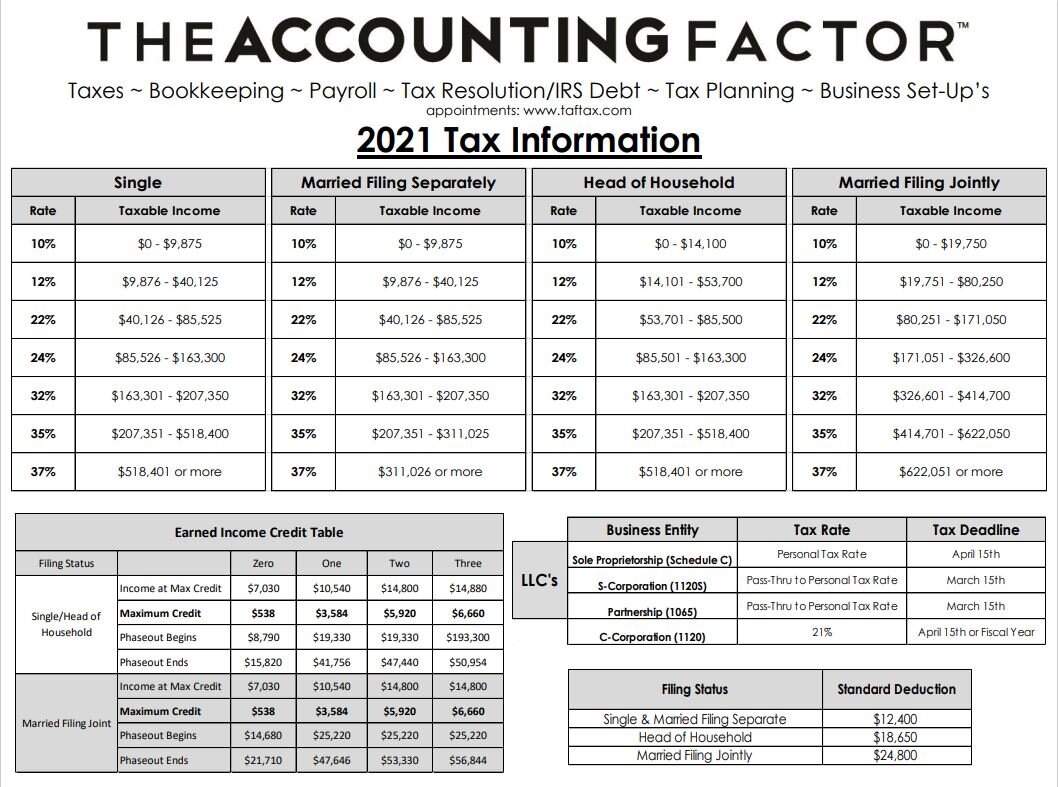

Calculate Tax Over 100 000 TaxLifeFinances

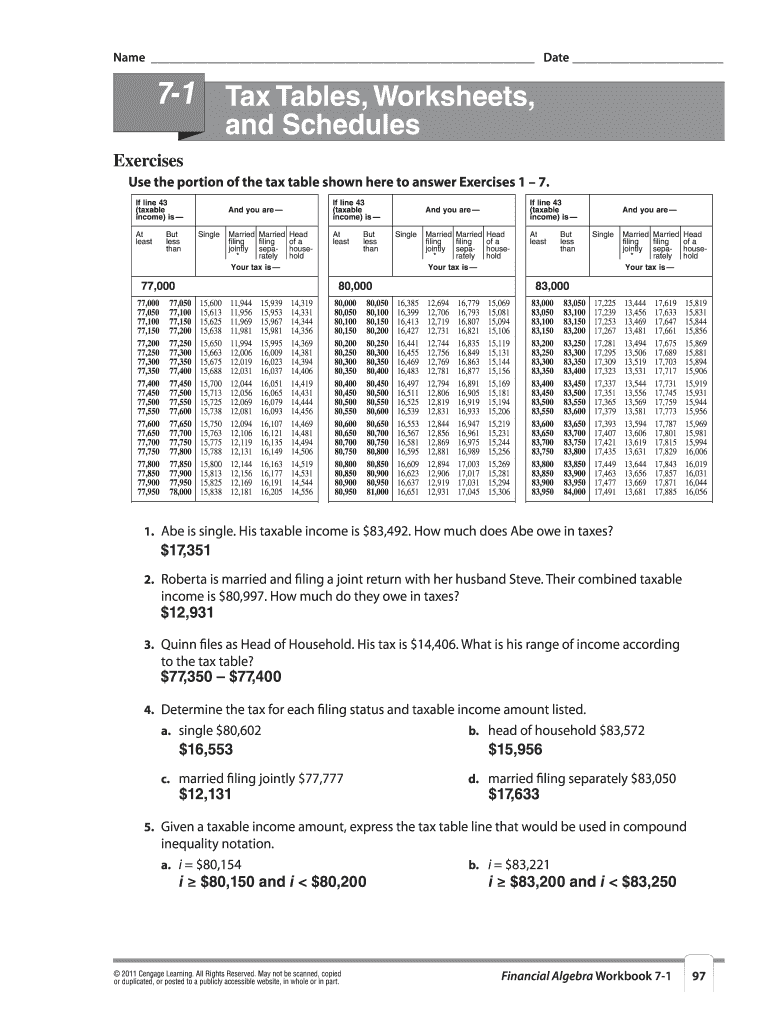

7 2 Modeling Tax Schedules Worksheet Answers Fill Out Sign Online DocHub

Easy Calculator For 2022 Qualified Dividends And Capital Gain Tax Worksheet excel 2016 Also Includes Tax Computation Worksheet Etsy

How To Calculate Your Tax Bill Using The Tax Computation Worksheet YouTube

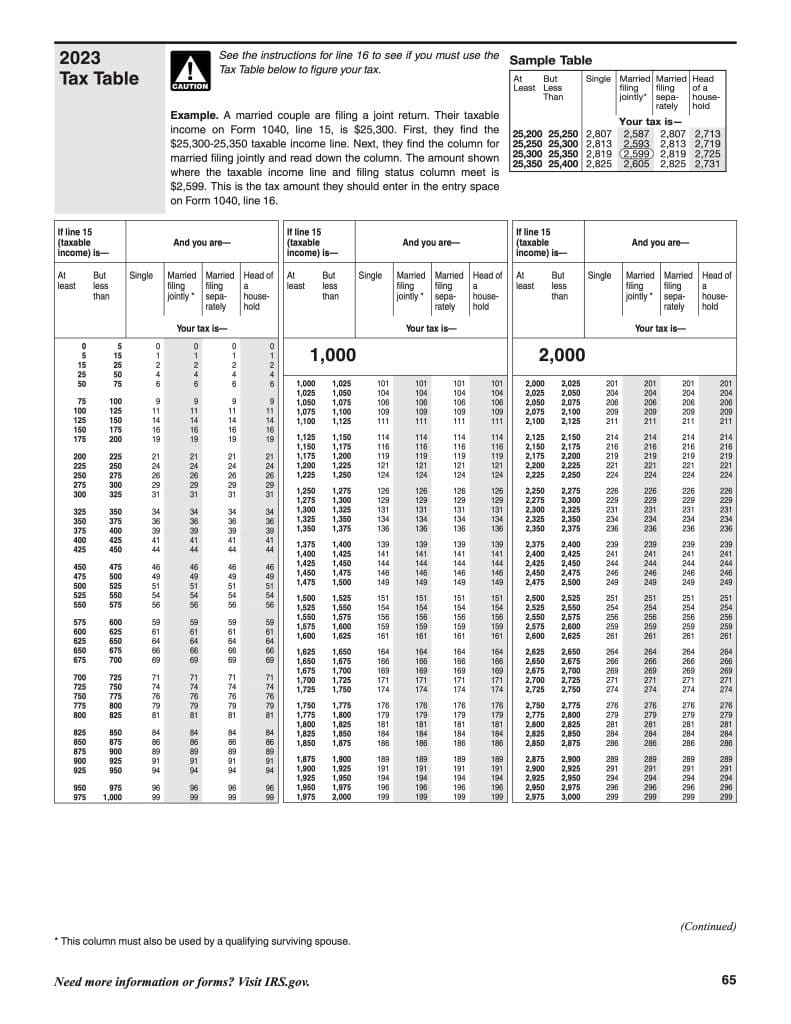

2023 Tax Computation Worksheet Fill Out Sign Online DocHub