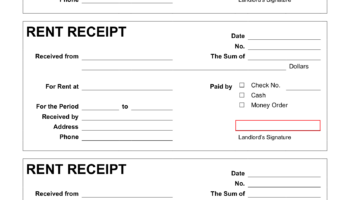

A document, often in PDF or spreadsheet format, designed for physical or digital printing, allows individuals to record and monitor financial outlays. It provides a structured framework to categorize spending, track dates, and calculate totals, enabling a clear overview of where funds are allocated. An example includes a pre-formatted sheet with columns for date, description, category (e.g., groceries, transportation), and amount.

The practice of diligently recording financial transactions offers numerous advantages, promoting enhanced budgetary control and financial awareness. Understanding spending patterns facilitates informed decision-making, assisting in identifying areas for potential savings and contributing to the attainment of financial objectives. Historically, individuals maintained handwritten ledgers; the evolution to printable formats offers a more organized and readily accessible method.

The subsequent sections will delve into the various types available, the key elements to consider when selecting one, and the effective strategies for utilizing these tools to achieve personal financial management goals. Further discussion will focus on customization options and alternative methods for tracking expenditures.