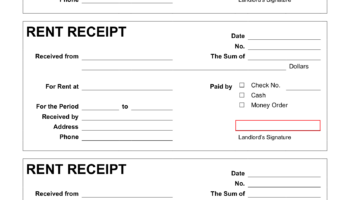

A budgeting tool, often available at no cost and designed for physical record-keeping, facilitates the systematic monitoring of financial obligations. These tools, typically formatted for printing, allow individuals to manually record due dates, amounts owed, and payment statuses for various recurring expenses. Examples include templates for managing utility bills, credit card payments, or loan installments.

Efficient expense management is crucial for maintaining financial stability and avoiding late fees or penalties. Historically, individuals relied on handwritten ledgers for tracking finances. The advent of readily accessible templates offers a structured and organized approach to this process, promoting awareness of financial obligations and supporting proactive budgeting habits. Using such a tool can empower individuals to better understand their spending patterns and make informed financial decisions.

The following sections will explore strategies for effectively utilizing expense management documents, discuss the various formats available, and provide guidance on selecting a format best suited to individual needs.